Posts

The 1st time I read this notion, it was from the a financial investment conference back into the brand new eighties and you can Jack Bogle, the fresh creator out of Cutting edge Assets, are speaking. He talked about his academic look you to definitely turned-out you to definitely simply no one can continuously beat the market over-long expands (for instance the forty years we have to invest for retirement). An informed you might a cure for was to meet the industry, and that provided you productivity one weren’t half bad.

a lot more pile exchange organizations

Even after its progressive search and features, Inactive spends a number of the earliest and you can simplest gaming formulas around. That said, such formulas are well-designed and you may result in a top RTP (Come back to User). Passive’s RTP is one of the higher of any on line slot servers in the market. Wisener has the right idea, however, other investors that provided moving away from effective finance to help you list finance state things such as, “I’ll try this to possess per year and discover the way it goes.” That’s essentially the wrong therapy. Annually, of many finance tend to overcome its benchmarks, and some does very for three, five, if you don’t a decade.

DRIPs are a great way so you can treatment for keep the opportunities compounding inside the a TFSA, RRSP or other income tax-protected membership. But We basically don’t highly recommend them inside non-joined profile, as they possibly can complicate your recordkeeping. For individuals who’lso are to make a few percentage-free deals every year anyhow, it’s better to only mop up the fresh sluggish money in to your nonexempt account during the time. Ultimately, mutual finance ensure it is simple to reinvest the withdrawals (dividends and you can focus repayments), meaning that indeed there’s no money resting idly on your membership.

The newest tale began in the 1960s which have nine Southern area Californians which got together on the Thursday nights to view Destroyed in dimensions. Contacting by themselves the brand new “Missing in proportions Pub,” they soon first started fulfilling to watch most other shows also. “Included in this,” the storyline continues, “recognized simply while the ‘The Hallidonian,’ in the near future generated the newest finding you to people day, any moment are alright to have lengthened, indiscriminate Tv seeing.” Crumb and his awesome Inexpensive Fit Serenaders, a somewhat trendy string band.

- These ETFs provide investors a just about all-in-you to profile service that’s global diversified and you may immediately rebalanced, that have a one-solution ultra-low-rates purchase.

- This is how the brand new psychoactive outcomes, amusement, and you can altered effect try most prominent.

- All-in-you to ETF portfolios are very really-varied, super-cheaper and simpler to handle than just a profile away from multiple holdings.

- However, in the process you’d to reside as a result of six ages where the 12 months-prevent really worth is lower than the earlier seasons.

- None of the Leading edge otherwise iShares resource allotment ETFs provides which blend, you’ll should look to possess another provider.

To buy ETFs within the Canada Tool: The new MoneySense ETF Screener

That’s after you rebalanced your own portfolio to the doing fifty/fifty blend of equities/fixed income. Many traders usually embrace a healthy portfolio.

Conventional traders do go for a lot more bonds than stocks, if you are competitive investors create favor far more holds than just ties. More youthful investors having many years going regarding the buildup phase you will hold an almost all-guarantee profile. They might yes need a top threshold for risk as well. Inventory and you may bond profiles usually takes time for you recover from field changes, even when bond-hefty profiles usually normally recover more easily than simply profiles that have more brings.

The newest inflation-assaulting possessions started initially to fall in the next one-fourth out of 2022. That’s where are the efficiency for the portfolio possessions to the same months. Here are the productivity to the personal assets to your months. All of the maps and you can dining tables in this article is actually due to portfoliovisualizer.com. Here’s the full return (as well as returns and dividend reinvestment) from January 2015 to help you September 2022. The period of time because of it evaluation will be based upon the new accessibility of the genuine BMO ETFs.

But perform the holdings during these financing perform and positively treated financing? I found myself a good investment mentor that have Tangerine away from 2013 to 2018. It actually was really rare to find a high-commission shared money mix one defeat the newest Lime approach along side long-label. Chalk one up to the reduced fees and the couch potato (indexing) investment strategy.

For nearly two decades, the new TD elizabeth-Show mutual finance was one of the cheapest and you can easiest a method to make a passive collection. For many of times they’ve moved regarding their team without much fuss, whilst outperforming the majority of the their colleagues. But now there are several changes in the fresh offing of these venerable old financing. There are many ways that somebody find fault using this type of collection – lower stock allowance, zero chance variations over the years, zero international coverage, no REIT finance. Partly as a result these types of, Injury has brought other differences like the Margarita Collection and Four square Portfolio. The newest Margarita Collection is 33percent Total Us Stock market, 33percent Total International Stock exchange, and you will 34percent Rising prices Safe Securities.

Gary Sinise Welcomes His Inner Inactive for brand new Pluto Television Post Promotion

Probably one of the most preferred inactive earnings channels are a home. Networks such REITs (Investment Trusts) will let you buy a house characteristics without having any trouble away from assets administration. Living Planner application helps you take control of your leasing income, track expenses, and place deals desires related to the home opportunities. If perhaps you were two and resigned from the ages 65, there’s simply a-1 per cent chance you to definitely two of you is actually still alive just after thirty years. There’s a 16 percent possibility that one of you try nonetheless real time.

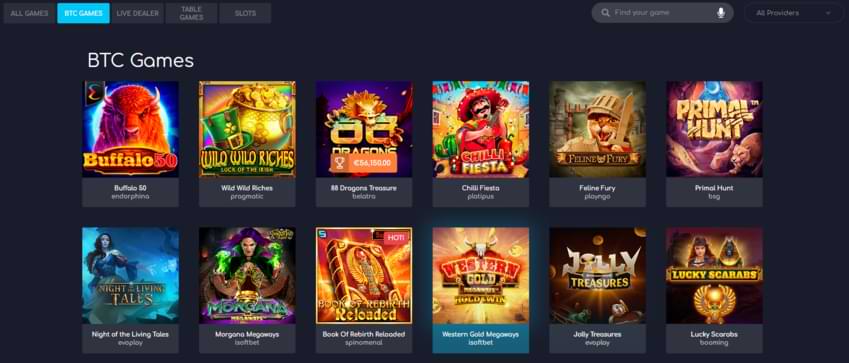

Moreover it features you to definitely capacity to recharacterize Us money since the Canadian returns from business group framework. This will make it just the thing for individuals who want to gamble its favourite ports away from home, without worrying regarding the getting involved with complicated have otherwise wishing long stretches for another bullet out of betting. In addition to, as the Couch potato slot is easily obtainable thanks to programs, professionals can also be play and enjoy any moment he’s specific sparetime – no need to watch for a vintage online casino to open up upwards its doorways.

Do you still you want around the world diversity in your collection? That’s practical question I tackle within event’s version of Crappy Money Information. Almost every other big professionals such Ripple (XRP) commonly making actions, which means this theory’s still kinda sus. It’s for example everyone’s whispering about it, but nobody’s willing to wager the fresh ranch. The individuals coins your believe had been at the very low once you bought them (and/or of them you are nonetheless hodling such they’ve been your own history slice from pizza)?

Four foundation points isn’t going to will let you retire before (it’s one latte a-year on every 10,100000 spent), but it’s a move around in the right guidance. The fresh elizabeth-Series fund need not liquidate the entire profiles and you can then buy ETF equipment for the replace. That might be everything you or I might have to do, but organization investors moving millions wear’t should do which.

• MERs cost a lot to own a collection finance and you may compared to ETFs. • The newest invested money is perhaps not for specific mission. It does maybe be taken for house renovations, take a trip, an such like. in the average to help you long haul.

ETF buyers would be to already appreciate this once they’ve picked between fund in identical advantage category from Leading edge, iShares and you may BMO, which often fool around with additional index team. Just in case the expense are the same, it’s hard to build a powerful argument you to some of these is naturally advanced otherwise inferior to the others. Take a look at the major holdings as well as the field breakdowns in the e-Show finance and also the relevant ETFs and you also’ll see he’s nearly identical.