Banking services provided by our partner, Green Dot Bank. All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track income and expenses. The software works very smoothly and is very intuitive. One of the most straightforward accounting software I have used. QuickBooks gives us real-time insight into our business operations and I appreciate that as it allows us to be more productive. Connect payroll, tax solutions, and 3rd-party apps to accelerate and enrich your work.

No one holds themselves accountable like accountants.

Track, create and send bills, and analyse profits from the comfort of your home. UOB BizSmart is an initiative to help you digitalise your business. We have teamed up with several digital partners to optimise business management processes such as invoicing, accounting, e-commerce, and more.View the UOB BizSmart page for more details. To process a refund in QuickBooks, click + New and select Refund Receipt.

- Keeping track of your workflow is vital to ensuring that your work is on track, and your team is working seamlessly.

- For example, if you run a business that requires you to send invoices and wait for your customers to pay you, you need QuickBooks to receive payment and keep track of outstanding invoices.

- Whether you just want help tracking receipts or you’re looking to automate complex workflows and support a large team, we have options for you.

- Simply put, the best accounting software is one that suits your unique needs.

- This article will walk you through the exact steps for receiving payments in QuickBooks, ensuring you can efficiently manage and apply payments to outstanding invoices.

Data safety

Kimberly has provided examples of their subject expertise by answering 2 questions submitted by students on Wyzant’s Ask an Expert. Integrates with InvoiceNow and UOB SME app to give you a smooth financial management system. No, you will need an internet connection to access QuickBooks Online as it a fully cloud-based solution. Our invoicing templates allow you to create custom, professional invoices, sales receipts and estimates.

Run your business with experts in your corner

Being a true cloud solution, there’s no need to install any software. You may access QuickBooks Online directly from your internet browser on any computer or web enabled device whenever, wherever. Get access to everything from discounts to marketing tools and exclusive training with Pro Advisor.

Invoicing and payments

Yes, you can record multiple payments for a single invoice. Use the bank feed matching feature if customers pay smaller amounts against your invoice. Click “Find Match” and apply each payment to the invoice. This ensures accurate records and properly settled invoices. To receive payments in QuickBooks, import your payment data using SaasAnt Transactions.

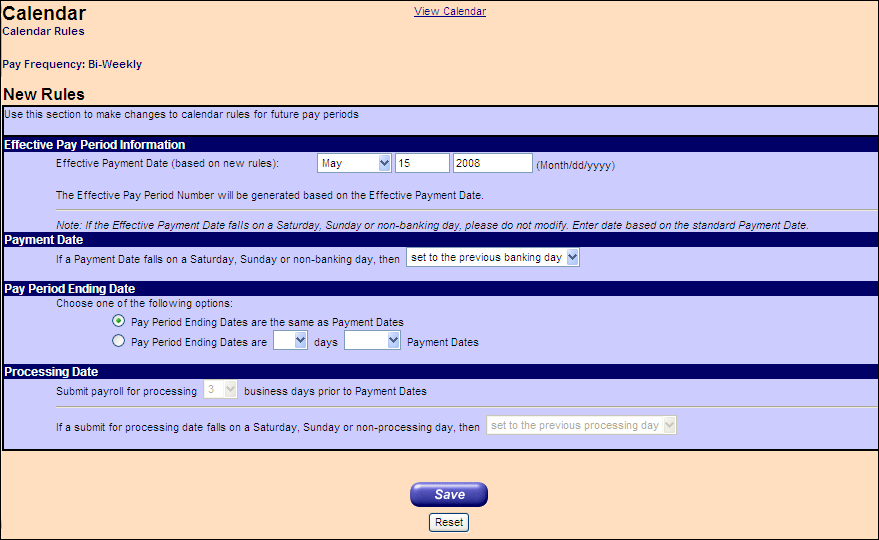

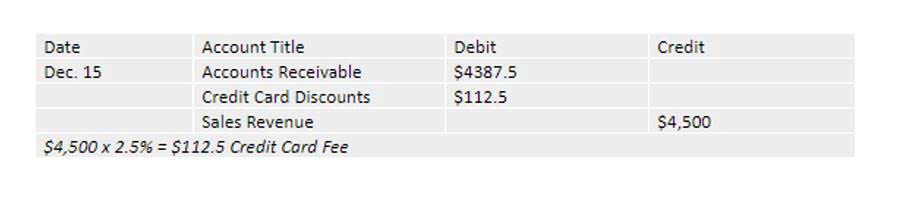

There are three plans to choose from to suit your business’ needs at an affordable monthly subscription fee. We recommend you choose the plan with the feature set that meets your business needs today, and you can upgrade to a higher plan as your business grows. Yes, QuickBooks charges fees to receive payments, which vary by method. Swiped payments incur a 2.4% fee, invoiced payments have a 2.9% fee, and keyed-in payments are charged 3.4%. Check the QuickBooks website for the most up-to-date pricing information. QuickBooks Receive Payment is a feature that allows users to record customer payments and apply them to outstanding invoices.

By minimising paperwork and manual tasks and automating workflow processes related to invoices, bills, and expenses, you can save time and focus on the more valuable aspects of your work. Close your clients’ monthly books with increased accuracy and in less time with new month-end review. Grow your practice and empower your clients with tools made just for accountants.

Learn how to add and manage customers in QuickBooks Online using this detailed guide. Sign in to your QuickBooks product from the selection below. Use the apps you know and love to keep your business running smoothly. All data transferred online is protected with 128-bit SSL encryption. When an invoice is past due, follow these five steps to collect outstanding payments so you can get paid sooner.

The software is very easy to use, even for people who do not have an accounting background. Manage your firm’s books with the powerful features of QuickBooks Online Advanced. Create professional invoices for free and get paid twice as fast. Answer a few questions about what’s important to your business and we’ll recommend the right fit.

I had several questions about how to adjust my quickbooks reports, checks and accounts. It was a great relief to work with such a competent Quickbooks tutor. Community College Accounting/Business Math/QuickBooks and Computer Instructor for over 10 years. I have taught Intro to accounting and Accounting 100 classes.

This will support your business growth and success. Follow these tips to simplify your payment processes and keep everything running smoothly. Simply put, the best accounting software is one that suits your unique needs. QuickBooks Online Accountant is an excellent solution for streamlining your accounting practice. By automating workflow processes, enhancing security and collaboration, and tracking your practice tasks, you can save time, increase productivity, and improve the quality of your work. The upgraded ‘Your Books’ feature provides a simple and effective way to manage your accounting practice, empowering you to grow your practice and deliver better service to your clients.

Try QuickBooks small business accounting software for free. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence. There are apps that integrate with it, you can log in on your phone, [and] the data is unfiled tax return information easily accessible to both the client and the accounting team. From bookkeeping to strategic advising, accounting pros have the power to be a financial superhero for small businesses. If that sounds like you, QuickBooks Online Accountant has the tools, training, and community to support you every step of the way.

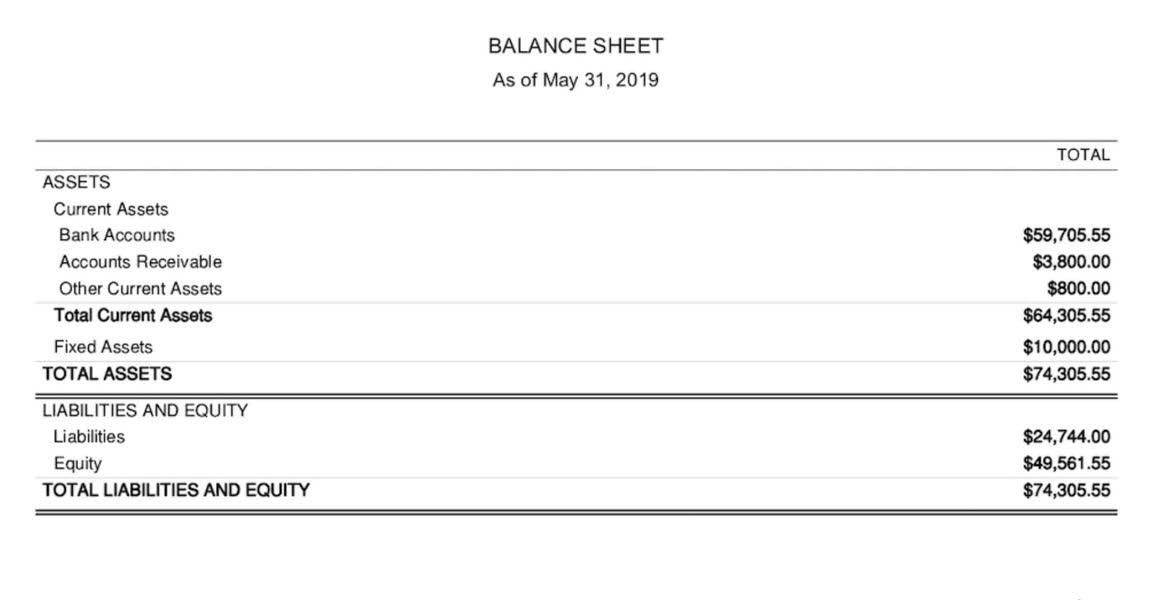

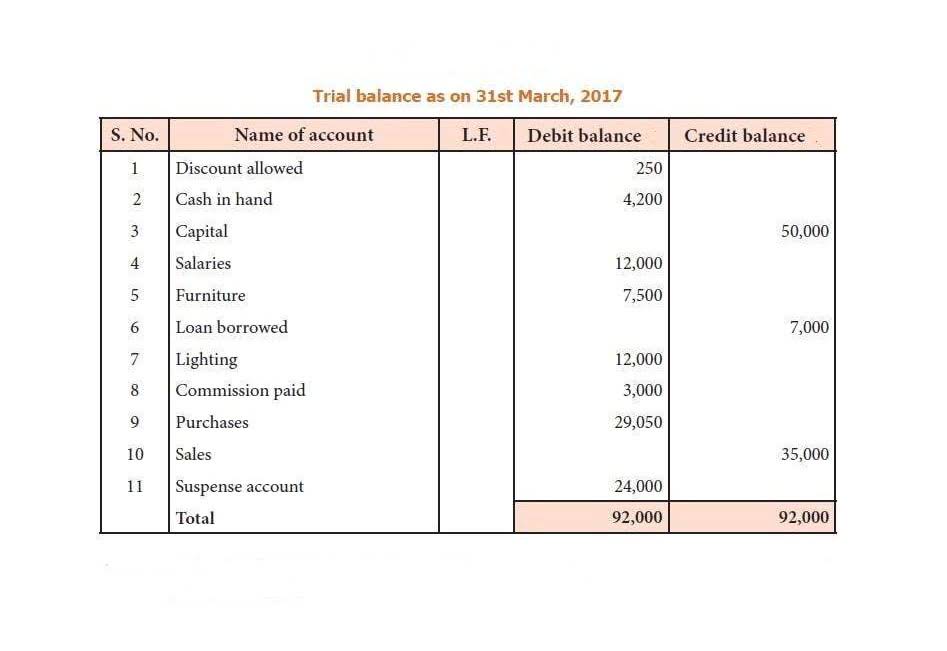

By accessing and using this page you agree to the terms and conditions. Learn to create meaningful reports and assess your business’s financial health using revenue, expenses, profits, and cash flow. In this episode, Harlem chocolate Factory founder Jessica Spaulding recalls a few of her early money management mishaps, and three big lessons learned. Customize estimates and convert them to invoices automatically. Solves the tedious process of accessing data for you and your clients.

QuickBooks Online Accountant offers an enhanced level of security with role permissions, ensuring sensitive data stays protected without compromising teamwork. You can create roles and assign required permissions, limiting access to sensitive information according to roles. This not only state of iowa taxes enhances security but also promotes seamless, transparent team collaboration. QuickBooks Online Accountant isn’t just a portal to your client’s books—it’s the one place to grow and manage your entire practice, at your pace. QuickBooks and Intuit are a technology company, not a bank.

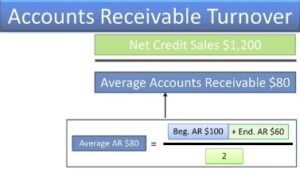

Then, open your customer list under the sales menu in the dashboard. Click on “Receive Payment,” enter the payment method and reference number, then save and close. For example, if you run a business that requires you to send invoices and wait for your customers to pay you, you need QuickBooks to receive payment and keep track of outstanding classified balance sheet definition format invoices. This function helps businesses accurately track their accounts receivable, ensuring all customer payments are accounted for and matched to the correct invoices appropriately. QuickBooks Online Accountant now provides an upgraded ‘Your Books’ section that provides an effective way to manage your accounting practice.

Accurately recording payments in QuickBooks Online is crucial for keeping your financials in order. By following best practices, you ensure smooth operations and happy customers. Use QuickBooks tools and integrations like SaasAnt Transactions to make the process easier. These tools help you automate data entry, saving time and reducing errors.

You can even photograph and save receipts with the QuickBooks Online mobile app. Here are five straightforward tips to keep your QuickBooks Online receive payments running smoothly and your financials in shape. Keeping track of every dollar coming into your business isn’t just bookkeeping—it’s the lifeblood of your enterprise. QuickBooks Online receives payment, ensuring you’re in the game and ahead of it, making every transaction count.

See how you can track and manage your whole financial picture in one place—from bank transactions, expenses, and beyond. Access a variety of self-paced and live training options to become a more trusted advisor. Hone your craft, prep for QuickBooks Certification, and earn CPE credits. Automatically identify and resolve common bookkeeping issues so the books are closed accurately and on time. Not only was I helped with difficult homework questions but also was taught the information to help me better understand how that relates to the homework.